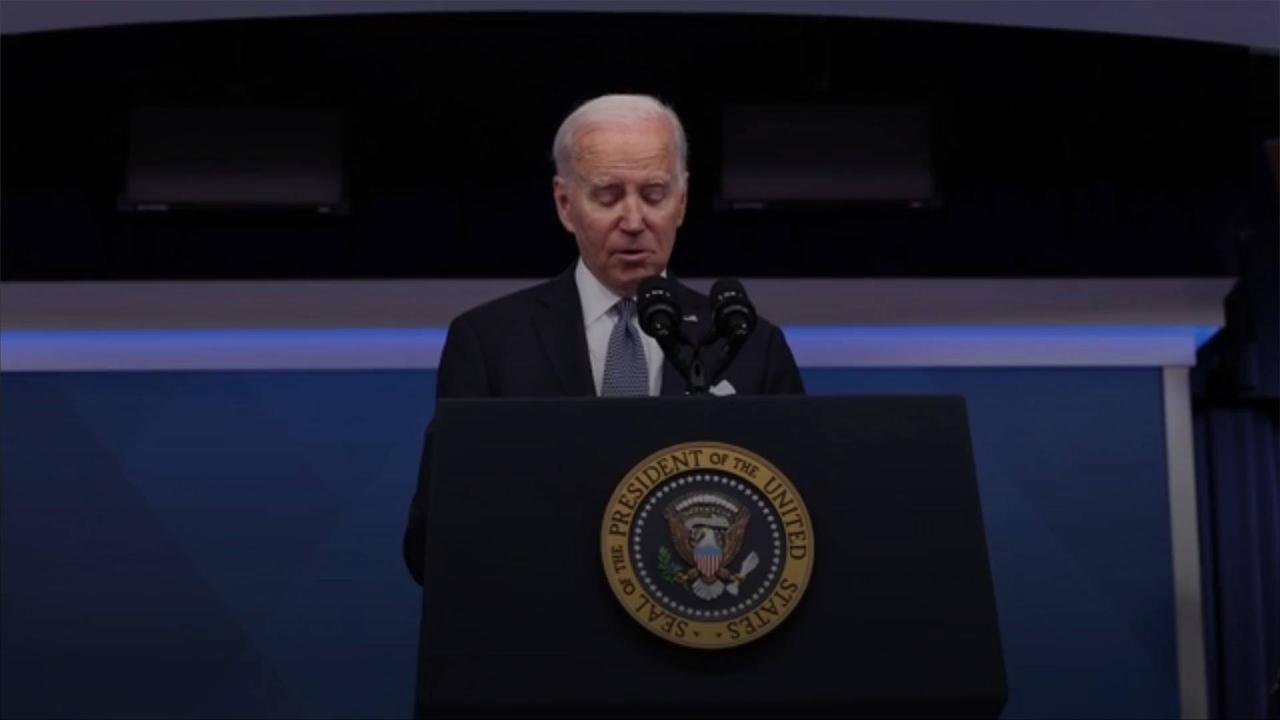

Biden Wants to Increase Tax Rate , on High Earners to Save Medicare.

'The Hill' reports that Medicare funding is on track to run out in 2028.

On March 7, President Biden unveiled a plan that would keep the program going for another 25 years.

He suggests increasing the tax rate for households that make over $400,000 a year from 3.8% to 5%.

Since Medicare was passed, income and wealth inequality in the United States have increased dramatically.

, White House, via statement.

By asking those with the highest incomes to contribute modestly more, we can keep the Medicare program strong for decades to come, White House, via statement.

Those who have both "earned and unearned income" over $400,000 would be susceptible to the tax increase.

High-income people are supposed to pay a 3.8 percent Medicare tax on all of their income, , White House, via statement.

... but some high-paid professionals and other wealthy business owners have managed to shield some of their income from tax by claiming it is neither earned income nor investment income, White House, via statement.

Biden's plan would also require pharmaceutical companies to contribute to Medicare when they raise prices quicker than inflation.

Additionally, Medicare Part D cost-sharing for some generic drugs would be capped at $2 per prescription each month.

Medicare would also have more negotiating power to decrease drug prices and "eliminate cost-sharing for three mental health or other behavioral health visits per year."