The global banking system may have already solved the problem of spoofed phone calls and online identities; the solution just needs to be explained to telco regulators and internet engineers.

The story begins in the aftermath of the banking crisis of 2007-08, when the leaders of the G20 countries sought to make it impossible to ever have another system-wide run on banks by instituting a Financial Stability Board that monitors global banking.

One challenge they faced is the impossibility of knowing how much financial risk is being taken unless you first know about all the banks that exist worldwide, and which banks own which other banks.

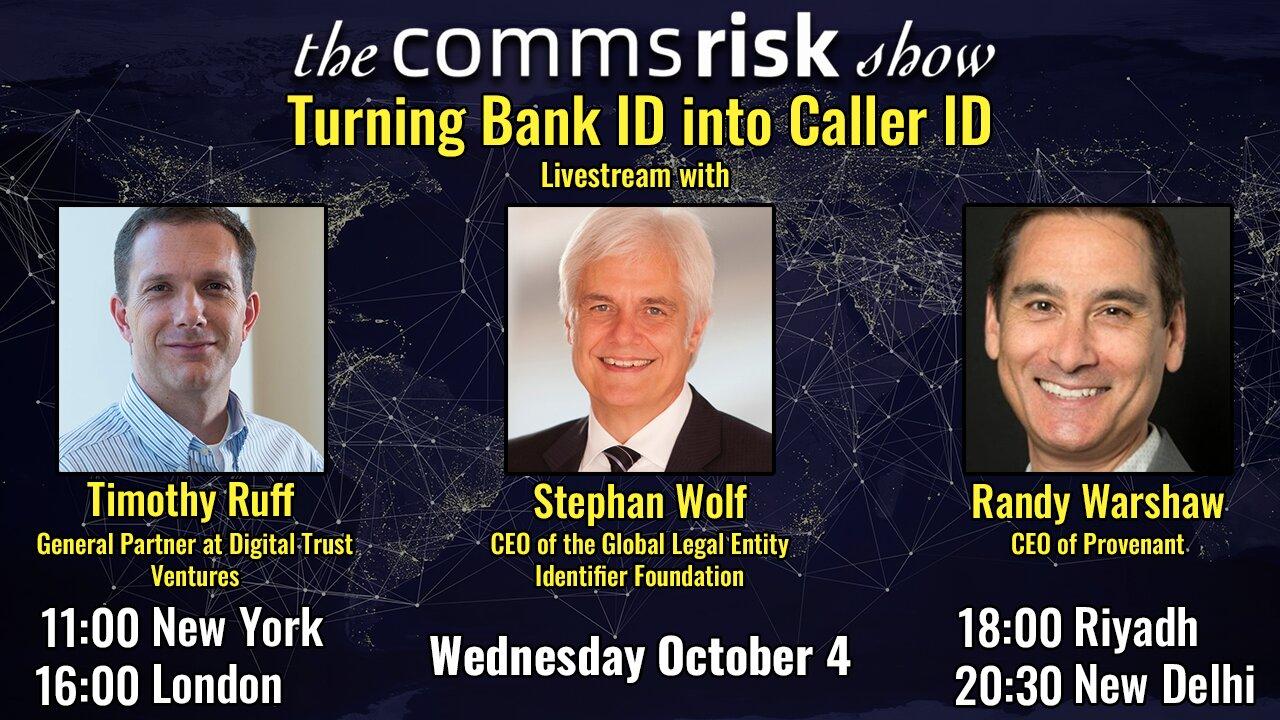

This was addressed with the creation of the Global Legal Entity Identifier Foundation (GLEIF) in 2014.

Some of the problems faced by the global comms industry have similar issues at root.

For example, US agencies like the Federal Communications Commission would like to reduce illegal robocalls but they never had a registry of all the comms businesses that make and convey calls within the USA, and their attempts to build a registry for foreign telcos are unlikely to ever succeed.

But what if the recipient of a phone call could tell who was phoning them because they were shown a secure digital signature that corresponds to the Legal Entity Identifier (LEI) of the originating business?

Such a method could obviously be applied to stopping scammers from impersonating banks, but could also be adopted by many other businesses too, and could eventually be generalized so that everybody has their own identifier, using the same technology and series of codes.